When you are trying to understand (or explain) the difference between your profit for the month and the actual change in your cash for that same month, accounts receivable will usually be a part of the story. You have accounts receivable when you sell your products or services on terms such that the customer does not have to pay you at the time you make the sale.

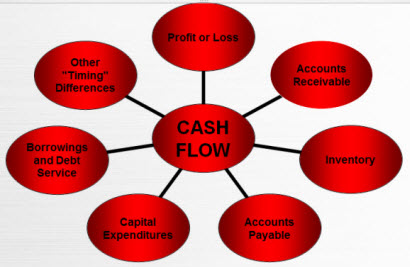

The first post in this series provided you a graphical view of the different drivers of cash flow. I have written this series to help you understand what each driver of cash flow means, how to write your one-line explanation in your Cash Flow Focus Report, and how to determine whether each change (or cash driver) is good or bad.

Here are some things to consider when accounts receivable is one of your three largest changes in cash for the month.

A positive adjustment related to accounts receivable means you collected more money from customers on your existing accounts receivable than you billed to customers during the month. (It means your accounts receivable balance on your balance sheet went down during the month.) Deciding whether that is good or bad requires that you look at what caused that to happen.

Here are some possible reasons for the change:

- You did a better job of getting customer invoices paid during the month. That would be good.

- Your sales on credit went down during the month. That could be good or bad depending on what you were expecting and whether it is a negative sales trend in the business.

A negative adjustment related to accounts receivable means you sold more on credit than you collected from customers who owed you money. It means your profit or loss for the month includes sales that you have not actually collected the cash for yet. (That means the accounts receivable balance on your balance sheet went up during the month.)

Your customers owe you more money now than when the month started. Deciding whether that is good or bad requires that you look at what caused that to happen. Here are some possible reasons for the change:

- Your sales on credit may have gone up during the month. Chances are that is a good thing since generally speaking higher sales would be good.

- It is possible that some customers are late in paying invoices they owe you. That would be a bad thing. And it would mean you have some work to do to fix the problem so customers are paying you on time. You should look at your accounts receivable aging to make sure that is not happening.

Diving Deeper into Accounts Receivable Changes

I have written a number of posts about how to stay on top of your accounts receivable. These posts will also help you better understand why there was a change in accounts receivable for the month so you can determine whether you have a cash flow problem brewing or not.

- I have seen many times in my career where a consistent focus on DSO (days of sales that are sitting, and oftentimes stuck, in accounts receivable) by the management team helps drive accounts receivable down and frees up much needed cash for a business.

- Collecting receivables, especially from large companies, can be much more effective when you shift your mindset from “collecting” to “expediting”.

- The accounts receivable aging report is a great tool for your staff charged with turning accounts receivable into cash. It’s also a great management tool for you. It helps you manage your receivables and how well your staff is performing their job.

Recent Comments